Source: Orion Advisor Services, AlphaGlider

INVESTMENT ENVIRONMENT1

COVID-19, a novel coronavirus, exploded into a pandemic during the first quarter. Without a vaccine readily available for at least 12 to 18 months, governments around the world enacted stay-at-home directives to combat this highly contagious and lethal virus (over 42,000 deaths worldwide as of 31 March). Although we won’t know for sure until the data comes in, most economists are confident that all major national economies entered into recession in March.

Global equity markets began to sell off in late February when COVID-19 began to visibly take hold outside of its country of origin, China. The MSCI All-Country World Equity Index IMI, a good proxy for global equity markets, declined 22.4% during the quarter, on a total return basis. Foreign developed markets performed inline with global markets, while emerging markets (MSCI Emerging Markets) performed slightly worse (-23.6%). The US market (S&P 500a) suffered a 19.6% decline in the quarter.

Fixed income markets rose modestly during the quarter, with longer duration and sovereign (i.e. government) bonds leading the way up. The Bloomberg Barclays US Aggregate Bond Index,e rose 3.2% during the first quarter.

In the US, the unemployment rate worsened from 3.5% in February to 4.4% in March — with jobs falling by 700,000. However, this Bureau of Labor Statistics (BLS) measurement was as of March 12, before the earliest stay-at-home orders were put into place in California. Based on the Labor Department’s weekly unemployment claims of nearly 10 million over the month’s last two weeks, we believe that the US unemployment rate exiting March just north of 10%. The US shed more jobs during the last two weeks of March than were lost during the entire duration of the global financial crisis of 2007-2009. The suddenness and severity of job and economic destruction was similar overseas. COVID-19 is effectively a natural disaster hitting every city and town around the globe, simultaneously.

Central banks around the world were the first government organizations to respond to the collapse in economic activity. Central banks of most major developed countries are now pegged near, or even slightly below, zero. This includes the Federal Reserve (Fed) which cut its benchmark overnight rate by 150 basis points during March to a range of 0-0.25%.

Source: Investing.com

Central banks also resorted back to a tool they used during the last economic cycle, quantitative easing. According to Capital Economics, the Fed and its counterparts in Japan, China, and the Eurozone pushed their balance sheets to a combined $21 trillion. The Fed’s portion of this reached $5.8 trillion, increasing by approximately $1.5 trillion in March alone. Most of this went to buying Treasuries, but also mortgages, municipal bonds, and investment-grade corporate debt. On 9 April, the Fed announced up to $2.3 trillion in new lending programs to businesses, and state and local governments. The Fed’s money printer go brrrrr.

Source: Board of Governors, St. Louis Fed, AlphaGlider

The central banks’ monetary stimulus was soon joined by promises of massive government fiscal stimulus. The US government’s version is named the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The $2.2 trillion cost of the CARES Act can be a bit hard to get one’s head around, so here are a few ways that help me think about it. $2.2 trillion is approximately $6,725 per American (not to be confused with the maximum $1,200 check going out to each qualifying adult). It is 48% of what the Congressional Budget Office’s (CBO’s) had estimated for federal government spending this fiscal year ($4.6 trillion) before the COVID-19 crisis. It is 61% of the CBO’s pre-recession estimate for federal government revenues ($3.6 trillion). It takes the budget deficit in 2020, estimated by the CBO to exceed $1 trillion before COVID-19 appeared, to at least $3.2 trillion, or 15% of last year’s US gross domestic product (GDP). It will push the US national debt to over $26 trillion, more than $6 trillion higher than when President Donald Trump entered the White House just over three years ago. Even adjusted for inflation, it is more than two times larger than the last recession’s bailout package, the American Recovery and Reinvestment Act of 2009.

Source: Visual Capitalist [note: graphic was created before the bill was finalized, before the total expenditure grew to $2.2 trillion]

The cost of the CARES Act is massive, yet it is still not enough in the eyes of government economists. The Treasury Department requested another $250 billion to replenish the $349 billion allocation to small businesses, and both Trump and House Speaker Nancy Pelosi have indicated the need for an additional stimulus bill by the end of April that could total over $1 trillion.

Source: Koyfin

COVID-19 triggered a demand shock for nearly all items, including oil. However, oil also suffered a supply shock (increase in supply), with the breakdown of a three-year old production agreement between Saudi Arabia and Russia that spurred both countries to flood the market in March. In a classic demonstration of supply and demand setting price, oil prices fell by nearly two-thirds during the quarter, as shown below. The elephant in the negotiating room, however, is the US fracking industry, which added a net seven million barrels a day to US oil production over the last dozen years, albeit at high marginal costs. Saudi’s previous attempt to bankrupt US fracking companies via low oil prices failed in 2015/16 as many US fracking companies successfully lowered production costs, and the pressure on Saudi’s oil funded budget was too high to sustain. But now that the US transformed from the world’s largest oil importer to its largest overall producer, US leadership is increasingly finding that its interests are becoming more aligned with those of Saudi Arabia and Russia and more against those of the US consumer. Trump acknowledged as much when he encouraged Russia and Saudi Arabia to cut production and threatened to apply tariffs on oil imported into the US, all in an effort to raise domestic oil prices that would benefit the US oil industry.

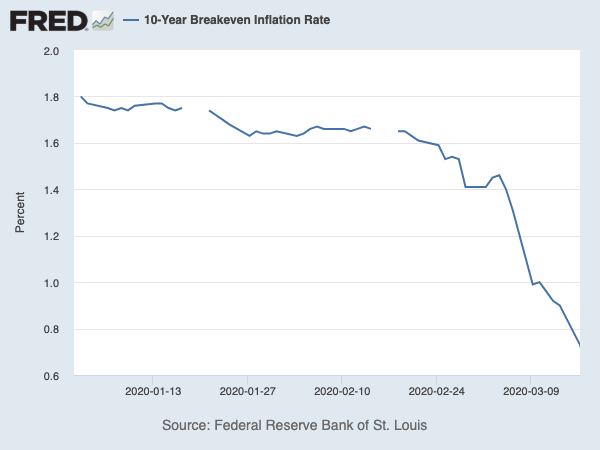

Source: Board of Governors, St. Louis Fed

Demand shocks from COVID-19 and the aggressive monetary response from the world’s central banks forced US rates to an all-time, end-of-day low of 0.54% in early March, and 10-year US inflation expectations to a cycle low of only 0.50% in mid-March (see chart above).

Despite aggressive monetary and fiscal stimulus efforts around the globe, most economists expect COVID-19 to drive sharp GDP declines in Q1 and Q2. However, the real debate amongst economists is what the economy will look like in the second half of 2020 and in 2021. Will the recovery be V-shaped or U-shaped, or will this coronavirus linger and inflict another round of damage to the global economy? Below is Goldman Sachs’ projection for US GDP which falls in the more optimistic, V-shaped camp: -10% for Q1, -35% for Q2, but +20% for Q3 and +10% for Q4, followed by high-single digit growth in first half of 2021.

Source: Goldman Sachs Investment Research

The major global economic and political issues of previous years took a backseat to COVID-19 during Q1, but they did not go away. The United Kingdom (UK) officially left the European Union (EU) on 31 January, although the two entities continue to operate under EU rules while they negotiate the terms of their future relationship over the balance of the calendar year. However, COVID-19 has delayed these negotiations. British Prime Minister Boris Johnson and the EU’s chief Brexit negotiator, Michel Barnier, have both contracted the coronavirus.

Tensions between Iran and the US simmered down after the US killed Iran’s top military officer, Qassem Suleimani, in early January. Iran may be temporarily distracted by an early and aggressive outbreak of COVID-19 that infected many of its politicians, as well as by March’s collapse in oil prices. But in a sign that Iran may be looking to retaliate against the US and its Middle East allies, Iranian-backed Houthi rebels launched Iranian-supplied ballistic missiles towards the Riyadh, Saudi Arabia’s capital and largest city. The missiles were intercepted and destroyed by Saudi anti-missile defenses.

China and the US agreed to refrain from escalating tariffs against each other’s imports last December to provide a more positive negotiating environment for future trade talks. However, progress towards a so-called “Phase 2” agreement that would set new trading terms, and lower or eliminate tariffs between the world’s two largest economies, appears to be stuck in neutral. In the meantime, US consumers continue to pay up to 25% tariffs on approximately $550 billion worth of Chinese goods while Chinese consumers continue to pay up to 30% tariffs on approximately $185 billion worth of US goods.

In US politics, the Senate voted to acquit Trump along party lines on the two counts of impeachment in early February. And after March’s presidential primary elections, we learned that Trump will face former Vice President Joe Biden in the November presidential election. Biden unexpectedly emerged as the Democratic Party’s candidate when most other moderate candidates exited the race in early March. Although all of the Democratic candidates pledged to rollback Trump’s 2017 corporate tax cuts if elected, Biden is generally considered to be among the more business-friendly in the Democratic field, and certainly more than Senator Bernie Sanders, the Democrat who had appeared to be on track to win the Democratic nomination throughout February. Trump is currently favored to beat Biden according to PredictIt, a popular US political betting website.

Source: Mike Luckovich

PERFORMANCE DISCUSSION

All of AlphaGlider’s strategies suffered losses during this difficult quarter for equities. Relative to their respective benchmarks, our three most aggressive strategies (AG-B, -MA, -A) outperformed, while our two most conservative strategies (AG-C, -MC) underperformed.

All but AlphaGlider’s conservative strategy (AG-C) were underweight equities during the quarter which benefitted their relative performance. Our strategies were also helped by their overexposure to government bonds and their underexposure to corporate and securitized bonds. At the fund level, AlphaGlider strategies benefitted from several US equity exchange-traded funds (ETFs)2 which outperformed the S&P 500 (-19.6%), including health care (Fidelity MSCI Health Care, FHLC, -13.0%), information technology (Fidelity MSCI Information Technology, FTEC, -13.5%), consumer staples (Fidelity MSCI Consumer Staples, FSTA, -13.5%), and consistent dividend grower (Vanguard Dividend Appreciation, VIG, -16.7%) funds.

The three primary areas that hurt AlphaGlider strategies during the first quarter were: 1) their overweight position in emerging markets (SPDR Portfolio Emerging Markets, SPEM, -24.3% and iShares ESG MSCI Emerging Markets, ESGE, -23.8%), 2) the low duration of their fixed income exposure, and 3) the overweight exposure to inflation-protected treasuries (Vanguard Short-Term Inflation-Protected Securities, VTIP, -1.1% and Schwab US TIPS, SCHP, +1.6%). The worst fund performers were Singaporean stocks (iShares MSCI Singapore, EWS, -28.1%), international real estate (Vanguard Global ex-US Real Estate, VNQI, -27.4%), and US value stocks (Vanguard Value, VTV, -25.1% and Nuveen ESG Large-Cap Value, NULV, -25.6%).

OUTLOOK & STRATEGY POSITIONING

The speed with which COVID-19 developed into a pandemic, and the equity markets collapsed, was breathtaking. The 11-year bull market came to an abrupt end, leaving our investment strategies and our clients’ portfolios dented, but not broken. We had plans set up in advance, when the sun was shining, and we stood by them when the storm clouds blew in.

Our plans start with matching the risk profile of our clients’ investment portfolios with their risk tolerance. There are many things that come to bear on one’s risk tolerance, most importantly the drawdown profile for anticipated spending from their investments, and their emotional resilience in the face of falling markets and monthly investment statement balances. The idea being that through suitable diversification of investments, there is no need or driving desire to sell securities that are hit hard by the bear market. Clients who need to liquidate part of their investments to fund near-term expenditures (e.g. retirees, parents with children nearing college, those saving to buy a house) have an appropriate portion of their portfolio dedicated to stable and/or inversely correlated assets (e.g. bonds) to cover those expenditures. The riskier portion of their portfolios (e.g. stocks) may have sold off aggressively, but it can be left untouched to recover with time because they have another portion of their portfolios that was stable and/or appreciating from which they can meet their spending needs. Likewise, clients without immediate cash needs but who lost sleep and/or sold out during previous stock market crashes (e.g. 2000-2001 dotcom bubble, 2007-2009 global financial crisis) were encouraged to use a more conservative AlphaGlider strategy than would be typical of similar investors their age and income bracket, in order to lower the volatility of their overall portfolio

Source: Bespoke Investment Group, AlphaGlider

Another major component of our plan is to let valuations, in light of earnings and cash flow projections, drive our asset allocations. Such a plan is in contrast to index investors, and in stark contrast to momentum investors (i.e. those who buy what is going up and sell what is going down). For example, an investor buying the S&P 500 index at the peak of the dotcom bubble would have had 35% of their investment tied up in technology stocks. A momentum investor at that time would have likely had the majority of their portfolio in technology stocks. And both would have been crushed by their large exposure to technology — the sector fell to about 12.5% of the index during the bursting of the dotcom bubble. Likewise, an index investor would have only held 5.5% of their investment in consumer staples stocks while a momentum investor would have likely had no exposure — and they would have both missed out on the sector’s strong relative outperformance. I recall this time like it was yesterday as I was the tech & telecom analyst for the Artisan International(ARTIX) fund at the time. We rode tech and telecom stocks on the front side of the dotcom bubble (we were up +81.3% in 1999), and then swapped into the safety of boring and beaten down sectors like consumer staples in January 2000. Our fund went on to suffer a 10.6% decline in 2000, but that was better than most of our peer developed foreign market growth funds and the foreign developed markets index, MSCI EAFE, which was down 14.2% that year.

Going into 2020, and in keeping with our plan to let valuations drive our asset allocations, we were underweight equities. We found US stocks to be significantly overvalued and foreign stocks to be merely fairly valued. In our overweight fixed income allocation, we were short on duration with a large dose of inflation protected securities given historically low interest rates and inflation expectations.

During the middle of March, three weeks into the COVID-19 induced selloff in global equity markets, we determined that valuations in foreign equity markets had probably overshot too far to the downside. The 20-40% year-to-date haircut to most foreign country equity indexes implied dire long-term profit growth assumptions, some as low as what we saw during the depths of the 2008-2009 bear market. The cyclically-adjusted price to earnings (CAPE, aka Shiller P/E) ratios had dipped below 12x in both emerging market and Singaporean equities, a level that in the past has been associated with low double-digit annual returns over the subsequent 10-15 years, on average. The CAPE for European equities dropped to around 14x, a level that frequently generated high single-digit annual returns over the following 10-15 years. US CAPE ratios also collapsed over this time period, but only to approximately 23x, implying an expected annual return of mid-single digits over the next 10-15 years if history repeats. Back during the depths of the last bear market, the US CAPE bottomed out at 12x.

Source: James Montier/GMO

As such, we decided to increase the foreign equity allocation of our strategies by selling completely out of our resilient US consumer staples position (FSTA) and partially selling down some of our rock solid, short duration Treasury positions (Invesco Treasury Collateral, CLTL and Vanguard Short-Term Treasury, VGSH), and rolling the proceeds into a new European equities position (Vanguard FTSE Europe, VGK). We also conducted a rebalancing exercise in our of strategies, which resulted in selling funds that had held their own during the market turbulence (generally fixed income) and buying funds that had been beaten up (equities).

Source: St. Louis Fed

We also increased our already large position in short-duration Treasury inflation-protected securities (VTIP) when the market’s implied annualized inflation rate over the coming decade fell from 1.8% at the beginning of the year, to around 0.7% in mid-March. Although recession triggered by COVID-19 is expected to suppress prices in the short-term (coming 1-2 years), we think it will be a non-factor over the bulk of the coming decade. In fact, we are concerned that the high level of US government debt and the massive levels of new fiscal and monetary stimulus could eventually trigger high levels of inflation. This investment will outperform that of similar duration fixed-rate Treasuries if inflation averages more than 0.7% over the coming decade.

As a reminder, we are long-term investors at AlphaGlider. We have little confidence in our ability to predict markets in the short-term, and we are highly skeptical of investors who claim that they can. However, the valuation tools that we use for our analytical analysis have had good success in predicting long-term (10-15 years) returns. As we see it, market volatility provides long-term opportunity if we stick to our plans, not risk.

The stock market is a device for transferring money from the impatient to the patient.

- Warren Buffett

In the Investment Environment section of this quarterly commentary, I highlighted the CARES Act in broad terms. There are a few items specific to individuals included in the CARES ACT of which you should be aware. First is that your household may soon receive a check or direct deposit to your checking account (up to a maximum $1200 per adult) if your recently IRS-reported household income was a below certain threshold. Approximately 80% of US households are expected to receive these payments. You can find out an estimate of how much of a payment, if any, your household will receive with this Washington Post calculator.

Second is that if you have a retirement account that is required to make required minimum distributions (RMDs), you are allowed to skip the RMD this year. This applies to people age 72 or older with a retirement account, or an owner of a beneficiary individual retirement account (IRA) regardless of their age. If this applies to you, and you have sufficient funds in your taxable accounts off which to live, we recommend that you take advantage of this RMD holiday in order to extend the life of your tax-advantaged funds. If you made a 2020 RMD within the last 60 days, you may have the option to undo it.

Third is that the Internal Revenue Service (IRS) is waiving the 10% early-withdrawal penalty on retirement account distributions of up to $100,000 if you, your spouse, or your dependent was diagnosed with COVID-19, or experienced adverse financial consequences as a result of being quarantined, furloughed, laid off, experienced reduced work hours, or lacked child care because of COVID-19. You would still need to pay income taxes on these distributions, but the IRS will allow you to spread them over the next three years. Also, you are allowed to repay the withdrawal back to the retirement account within three years of the distribution. If you have the means to fund your expenses without taking an early-withdrawal from your retirement accounts, we recommend that you pass on this penalty-free distribution.

Fourth is that any federal tax payments due on April 15 from your 2019 Form 1040 and your 2020 estimated taxes have been pushed back to July 15. Likewise, you now have until July 15 to make your 2019 contributions to IRAs and Health Savings Accounts (HSAs).

The CARES Act also includes many benefits to individuals who are self employed or own small businesses. If you have any questions about any of these provisions or other aspects of the CARES Act, please don’t hesitate to contact me.

Finally, we are pleased to announce that we made our 2019 1% for the Planet contribution to the Sierra Club Foundation. This foundation is the fiscal sponsor of Sierra Club’s charitable environmental programs, many of which are dedicated to finding solutions to mitigate and adapt to our planet's climate crisis. COVID-19 may be the nearest-term threat to every human on earth, but it pales in comparison to the damage that climate change may inflict on us as a species going forward.

On that not-so-happy ending, I sincerely thank you for the confidence and trust you have placed in AlphaGlider.

![Source: Visual Capitalist [note: graphic was created before the bill was finalized, before the total expenditure grew to $2.2 trillion]](https://images.squarespace-cdn.com/content/v1/56c237b2b09f95f2a778cab2/1586802670979-OAP3ED6Z1BOIUJ5DO7I3/CARES+Act+%40VisualCap.jpeg)