Efficiency begins with our fees.

Every dollar you don't pay in fees is a dollar added to your investment returns.

The fees and commissions you pay to invest — what you pay to your advisor, fund companies, and custodian, are a key driver in the success of your investments over the long-term. That's why we built AlphaGlider with low, transparent fees at every level:

Investment Advisory Fees

AlphaGlider receives only one form of payment — investment advisory fees on the average value of assets we manage for you.

Our annual investment advisory fee starts at 0.75% for households with $150,000 to invest. How does that compare with other investment advisors? Pretty well, it turns out. Actually, very well.

One of our competitors runs an account aggregation service which over 1.3 million people use to track their household net worth. They found that most of their users with investment advisors pay in excess of 1.0% in annual investment advisory fees.

AlphaGlider advisory fees are among the lowest in the field of active advisors:

Average Annual Advisory Fees, by Custodian

Source: Personal Capital, AlphaGlider

Note: Personal Capital and AlphaGlider fees based on a client with $150,000 in managed assets.

Fund Management Fees

Fund management fees are paid to the companies that manage the funds1 we use in our investment strategies. These fees are automatically deducted from the funds' share prices on a daily basis.

We primarily build our AlphaGlider investment strategies with low-cost exchange-traded funds (ETFs) that are passively managed to indexes.2 We are completely independent from the fund management companies which supply funds to our strategies, and we do not receive back-door payments from them, unlike some of our competitors.

Fund Management Fees, AlphaGlider Strategies vs Average Mutual Funds

Source: AlphaGlider, Investment Company Institute

*NOTE: AlphaGlider Core Strategy fund management fees as of December 31, 2024, and are subject to change without notice. Average equity and bond mutal fund expense ratios are simple averages during 2024 by the Investment Company Institute 2025 Investment Company Institute Fact Book, pg. 84.

Average Fund Management Fees of Advisors, by Custodian

Source: AlphaGlider, Personal Capital

NOTE: AlphaGlider fund management fee is for the AlphaGlider Global Balanced Strategy (AG-B), as of December 31, 2024, and is subject to change without notice.

Low Fees and the Power of Compounding

Add it all up and you see that AlphaGlider delivers a professionally managed active investment portfolio at less than one-half the cost of the typical investment advisor.

All in, AlphaGlider fees are among the lowest in the field of active advisors:

Average Total Fees of Advisors, by Custodian

Source: Personal Capital, AlphaGlider

**Notes & Disclosures**:

a) Total fees includes investment advisory fees and fund management fees, but excludes trading commissions which were not measured by the Personal Capital white paper.

b) AlphaGlider fees based on a client with $150,000 invested in the AlphaGlider Global Balanced Strategy (AG-B), as of December 31, 2024, and is subject to change without notice.

Your savings go directly to your annual returns.

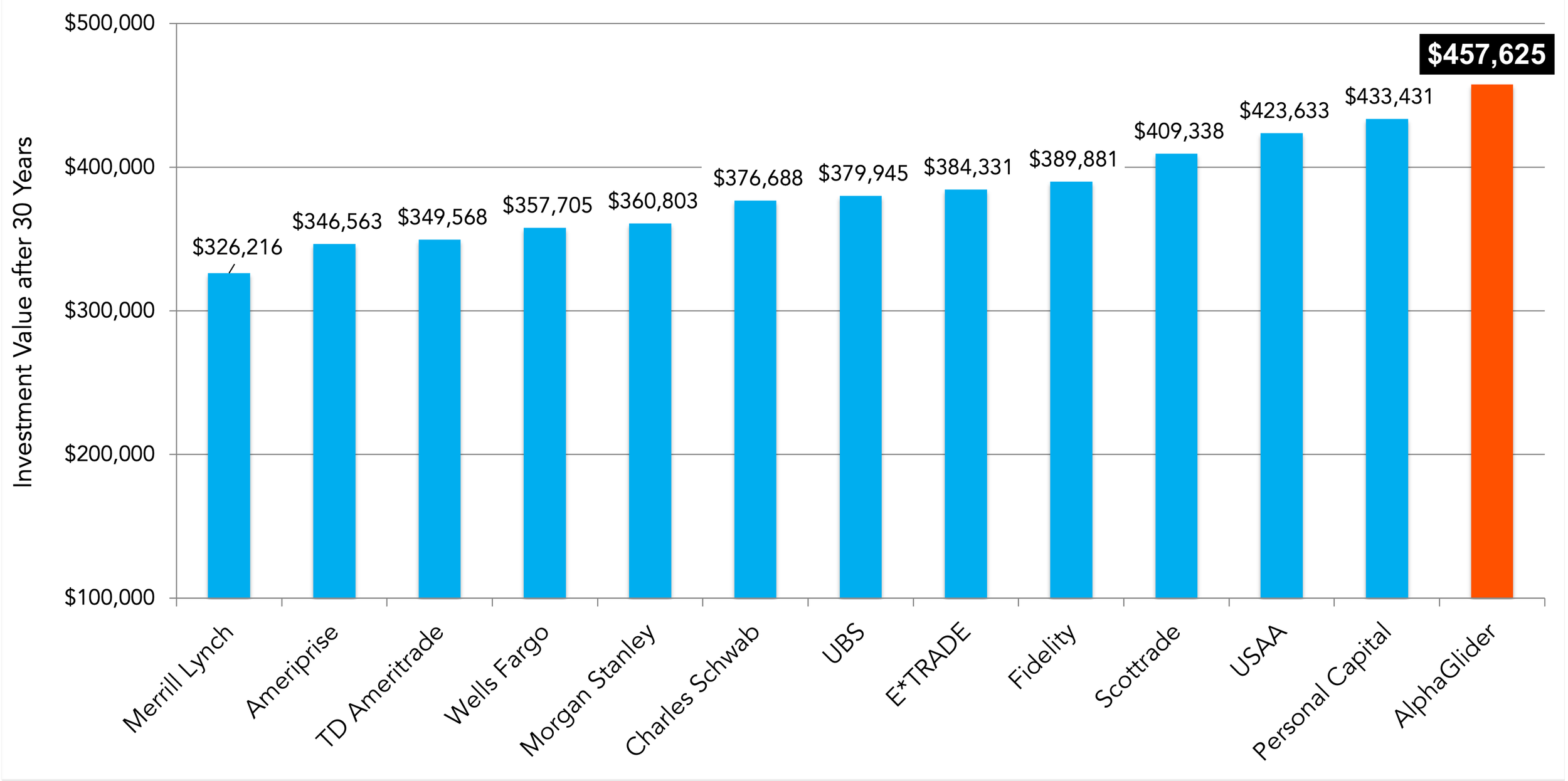

While seemingly modest in any given year, your savings compound over the years to become serious money. As the chart below demonstrates, our lower costs deliver an additional $24,000 to $131,000 over 30 years on an initial investment of $100,000, versus our peers [assuming 6% gross returns in a tax-advantaged account (e.g. individual retirement account) for all advisors].

Every dollar, or hundreds of thousands of dollars, you don't pay in fees is a dollar added to your investment returns:

$100,000 Invested with Advisors for 30 Years, by Custodian (assuming 6% gross returns for all advisors, including AlphaGlider)

Notes & Disclosures:

a) Assumes client assets are in a tax-advantaged account (e.g. individual retirement account).

b) AlphaGlider fund management fee is for the AlphaGlider Global Balanced Strategy (AG-B), as of December 31, 2024, and is subject to change without notice.

c) This is a hypothetical example that is demonstrating a mathematical principle. It does not illustrate any investment products and does not show past or future performance of any specific investment. Investing involves risk, including loss of principal.

Custodian Fees

Custodian fees are the third form of fees that AlphaGlider clients pay. As the name implies, custodian fees are paid to the custodian of your accounts.

AlphaGlider recommends Charles Schwab & Co., Inc. (“Schwab”)3 as the primary custodian for your accounts. By using Schwab as primary custodian, AlphaGlider has access to a wide range of products and services that help us serve our clients, including:

- Full range of investment products and trading services

- Technology and service support

- Wide array of investment account types including retirement accounts, charitable giving, and education accounts

- Full range of investment options such as stocks, mutual funds, bonds, exchange traded funds, CDs, and other investments.

- Technology and service support so investors can access all their accounts online and view positions, balances and account histories in one place.

Schwab does not charge an annual fee on its investment accounts, nor does it charge commissions on ETF trades, but does apply customary charges on various services such as fund and wire transfers.

The primary custodian fees on AlphaGlider 529 Educational Savings Plan accounts are admininstration fees of 0.11% of assets, charged annually by our independent 529 custodian, my529. As we only utilize commission-free, low cost, no-load mutual funds within AlphaGlider 529 accounts, there are no trading commissions in these accounts.