Photo by

Antonio Guillem/Wikipedia

One of the best parts of my job is that I get to work with so many clients I've been friends with since middle school, high school, college, and graduate school. So as financial advisor closer to 60 than 50, I naturally have many clients/friends who are starting to think about retirement and what that means for their lives. It can be a scary time, mainly because so much of our self esteem and accomplishments are intertwined with our career, but also because we will be without a steady paycheck for the first time since coming out of school. I sincerely enjoy helping these clients/friends through this transition. One tool in my financial planning tool bag that I have found to be helpful to many of them has been the Roth conversion.

Source: Fidelity Investments

A Roth conversion is the process of moving money from a traditional pre-tax retirement account—such as a traditional Individual Retirement Account (IRA) or 401(k)—into a Roth IRA. When you convert, the amount transferred is treated as taxable income in the year of conversion. The key benefit is that once the funds are in a Roth IRA, all future growth and withdrawals (if taken after age 59½ and meeting the five-year holding period) are tax-free. In essence, you are choosing to pay taxes today to avoid higher taxes on future withdrawals.

Another Roth benefit is that there are no required minimum distributions (RMDs) as there are for traditional pre-tax retirement accounts. A Roth IRA is also substantially more valuable to a non-spouse beneficiary than is a similarly sized traditional pre-tax retirement account—not only because Roth distributions are tax-free, but also because your beneficiary can let the full amount of the Roth grow tax free for 10 years before taking the tax-free distribution. While inherited traditional pre-tax retirement accounts also do not have to be emptied for 10 years, it usually makes sense for the beneficiary to make annual distributions over the 10-year period so as to avoid being pushing up into a higher marginal tax bracket in any one year—losing some of the tax-deferred benefits of the account.

A Roth conversion tends to make the most sense when your current marginal combined federal and state tax rate is lower than your expected future tax rate. If you expect to face higher tax rates down the road, paying taxes now at today's lower rates can result in significant long-term savings. This scenario commonly arises in several situations. For instance, someone who has recently retired but has not yet begun taking Social Security or RMDs may find themselves temporarily in a lower tax bracket. Those years—often called the “tax planning window”—present a prime opportunity to convert funds at relatively low tax rates. Similarly, if you currently reside in a low-tax state but plan to move to a state with higher income taxes, converting before the move allows you to pay taxes at a lower tax rate. Another case arises when you anticipate that tax rates in general will rise over time—whether due to fiscal pressures, political changes, or expiring tax provisions—making it advantageous to “lock in” today’s lower rates. Roth conversions can also make a lot of sense after a big drop in the markets. Taxes due on the conversion will be lower, and the eventual rebound in prices will never be taxed.

However, Roth conversions come with important financial and tax implications that must be considered carefully. One key factor is that you need non-retirement (i.e. taxable) assets available to pay the taxes due on the conversion. Using funds from the retirement account itself to cover the tax bill will reduce the long-term benefit of the strategy and, if you’re under 59½, may even trigger penalties. Additionally, increasing your adjusted gross income (AGI) through a Roth conversion can push you into higher income thresholds that may negatively affect other areas of your financial life. For example, a higher AGI can result in increased Medicare Part B and D premiums (known as IRMAA surcharges), push realized long-term capital gains into higher tax brackets, reduce eligibility for income-based credits, deductions, and subsidies such as those under the Affordable Care Act, reduce the new “senior bonus deduction” introduced by the One Big Beautiful Bill Act (OBBBA), and negatively impact one’s eligibility for federal education financial aid programs.

Because of these nuances, Roth conversions should be viewed as part of a long-term tax management strategy, not just a one-time transaction. Thoughtful modeling of your current and projected future tax situation—along with consideration of state taxes, investment horizons, and estate goals—can help determine whether a conversion provides meaningful after-tax benefits. The analysis is too complex for back of the envelope calculations or Roth conversion calculators you may find on the Internet. With AlphaGlider Planning, our new financial planning software from RightCapital, we now have an excellent tool to identify Roth conversion opportunities. Once identified, we ask that our clients review the model’s findings with their tax advisor to confirm if a Roth conversion is right for them.2

Let’s now take a look at how AlphaGlider Planning conducts a Roth conversion analysis for a hypothetical couple, John and Jane Smith. They are both 60 years old, and they plan to retire in two years. They currently have $100k in cash and $3m in investments, of which $1.5m is in a joint taxable account ($1m cost basis), $1.3m in their various 401(k)s and traditional IRAs (the amount available to be converted to Roths), and $200k in their Roth IRAs. These investments are in a 60/40 equity/fixed income portfolio, with the equity and fixed income investments fairly equally distributed across account types. They plan to delay starting Social Security until they each reach 70, which AlphaGlider Planning determined would maximize their lifetime payments if they both live until age 95. The Smiths currently live in Texas but anticipate moving to California in six years to be closer to their two children and their partners, and they hope some grandchildren by that time.

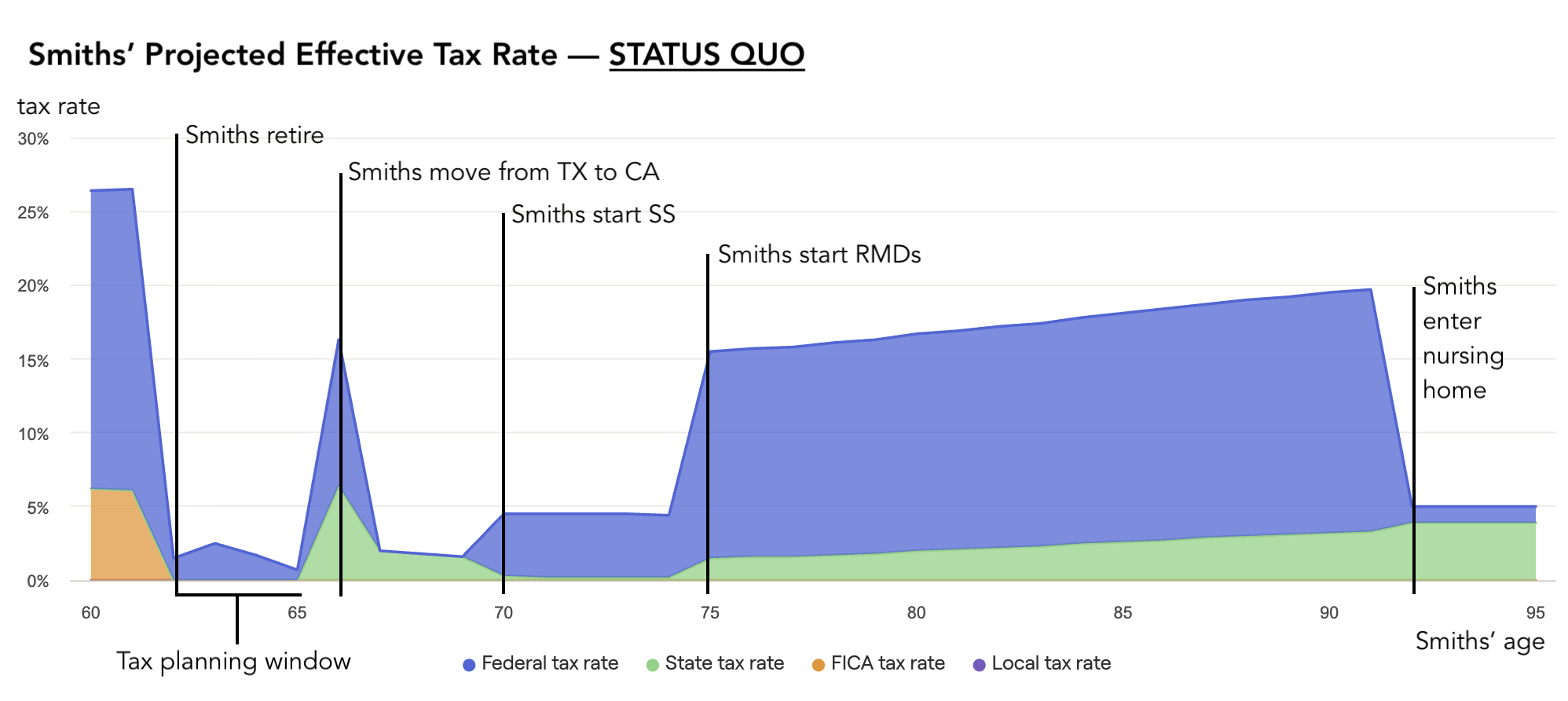

Once the Smiths retire in 2027 at age 62 but before they move to California in 2031, they will be in the “tax planning window”—when they will temporarily enjoy a low tax bracket. In 2027, their AGI is expected to fall to less than $50,000 (their only taxable income will come from interest, dividends, and realized capital gains from their taxable investments), putting them into the low 10% marginal federal tax bracket. While living in Texas, they are not exposed state income tax. But they will start to incur state taxes when they move to California at age 67, and their taxable income will increase when they start Social Security at age 70 and then again at age 75 when they are both forced to take RMDs from their traditional (pre-tax) retirement accounts (the starting RMD age for those born in 1960 or later is 75; for those born from 1951 through 1959, the starting RMD age is 73). The chart below shows the Smith’s projected effective combined tax rate between now and age 95, the end of the planning period.

Source: AlphaGlider with data from RightCapital

The chart shows the dramatic drop-off in the Smiths’ effective tax rate when they retire at 62, and the progressive increase in that rate as they relocate to California (age 65), start Social Security (70), and start RMDs (75). The temporary spike in their effective tax rate at 65 is due to paying capital gains taxes to generate funds to buy a home in California’s more expensive real estate market, and the decline in that rate near their end of life is due to federal deductibility of nursing home expenses.

AlphaGlider Planning projects that the Smiths’ investments will grow to ~$6.75m by the end of the plan, $2.71m of which will be in tax-deferred accounts that will eventually be taxed after being inherited by the Smiths’ California-based children. Assuming these tax-deferred accounts face a 30% combined federal and state tax when the children take distributions, the after-tax value of these investments will be reduced to ~$5.93m.

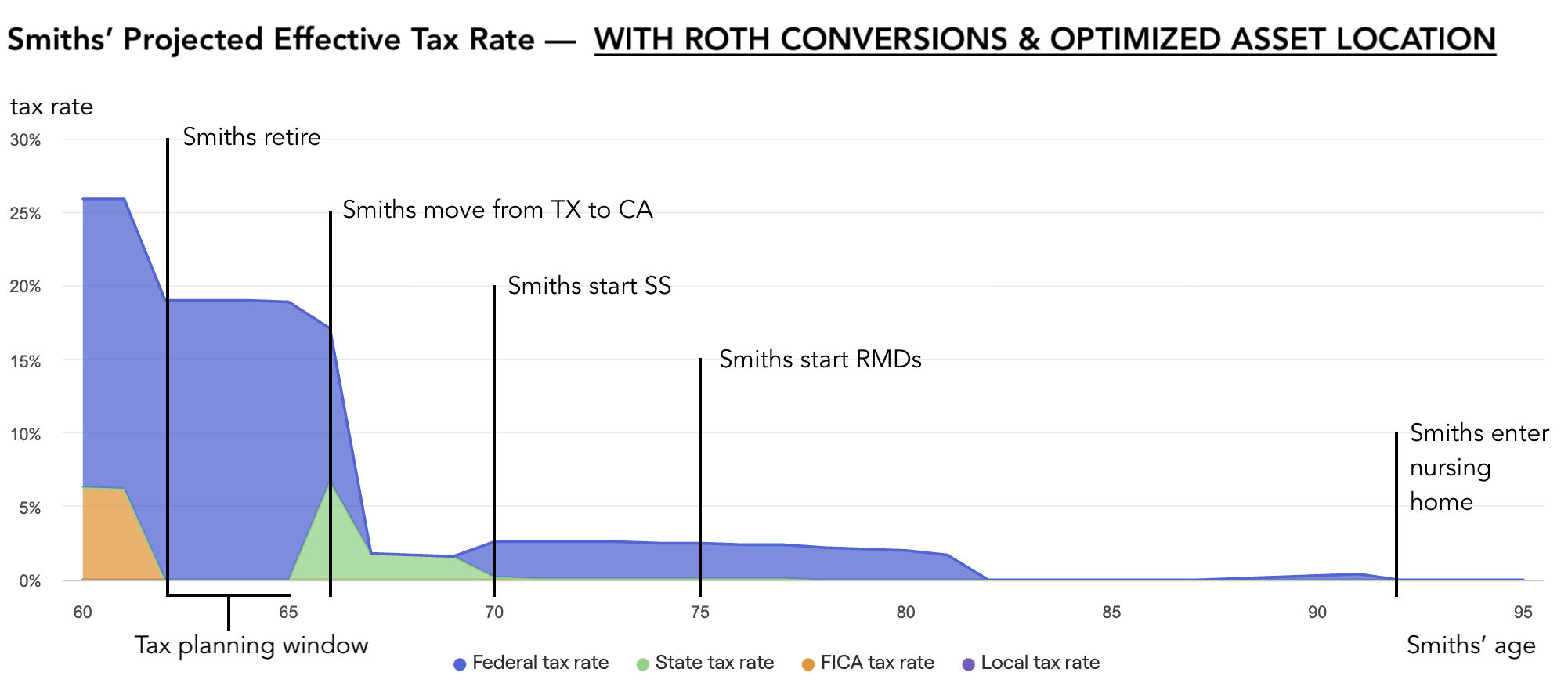

Now let’s look at the Smiths’ situation if they follow AlphaGlider Planning’s two tax planning recommendations: 1) make annual Roth conversions in the first four years of their retirement, up to the amount that fills their 22% federal tax bracket, and 2) tax optimize the location of their investment assets (prioritized equities in taxable and tax-free (i.e. Roth) accounts, fixed income in tax-deferred (i.e. Traditional retirement) accounts. As the chart below shows, the Smith’s projected effective combined tax rate will increase from low single digits to approximately 19% during the four years of Roth conversions, but will then fall from the upper teens into the low single digits throughout most of their retirement years. The model projects that the Smiths will actually pay little to no California state tax from age 70.

Source: AlphaGlider with data from RightCapital

As shown on the following chart, the model projects that the Smiths’ investments will grow to ~$6.95m by the end of the plan with the Roth conversions and tax optimized asset location, and 100% of these assets will be tax free to their heirs. This is a significant $1.02m improvement (17%) in the after-tax value of their investments at then end of the plan. Approximately 70% of this improvement comes from Roth conversions with the balance coming from tax optimized asset location.

Source: AlphaGlider with data from RightCapital

In performing this analysis, AlphaGlider Planning assumes static capital market investment returns over the entire period of the plan. But if there’s one thing we know for certain it is that investments returns will be wildly variable from year to year, and on average could deviate significantly from our assumed returns, either better or worse. Just as it is beneficial to make a Roth conversion after a big drop in the market, it can be painful to make one just before a big drop in the market. Therefore, it is always important to review AlphaGlider Planning’s Monte Carlo simulations to determine if the recommended Roth conversions have a negative impact on probabilities of running out of investments before the end of the plan. In the reference strategy (no Roth conversions or tax optimized asset location), AlphaGlider Planning estimates that there is a 12% chance that the Smiths will deplete their investments before the end of the plan—the same chance it models with Roth conversions and tax optimized asset location. Put simply, we do not expect the two tax planning recommendations to meaningfully change the Smiths’ risk of running out of investment funds in retirement.

The benefit of Roth conversions to the Smiths could be even larger if tax rates go up in the future, a scenario we believe to be highly likely. The current financial picture of the federal government is concerning, with the recently completed fiscal 2025 deficit hitting nearly $2 trillion—pushing the federal debt held by the public over $30 trillion (~100% of GDP). As shown in the chart below, the US raised only 70 cents for every dollar it spent during a robust year of growth. Interest payments alone is now the the third largest category of outlays, having recently exceeded Medicaid and national defense. Spending is set to only increase going forward as four of the government’s top five spending categories will continue to increase due to the country’s aging demographics, rising debt and elevated interest rates, and renewed prioritization of the military. The current administration had said that its Department of Government Efficiency (DOGE) could cut trillions from the annual budget, but that initiative appears to have failed miserably. Controlling deficits through the revenue side also look doubtful after passage of the One Big Beautiful Bill Act (OBBBA). Trump’s tariffs (customs duties in the chart) are starting to generate significant revenue, but at ~$200 billion per year going forward (+/- $50 billion), they only cover about 3% of last year’s spending. That is why most reputable forecasts of the annual deficit have it progressively increasing from its current $2 trillion level to over $3 trillion over the next 10 years.

Source: US Treasury, AlphaGlider

In this scenario, bond investors will eventually force the US to face its debt problem by demanding higher interest rates on the money they loan to the US. When this happens, we think that politicians will be forced to raise today’s historically low tax rates for individuals and corporates. Roth conversions are a good hedge against this eventuality, as you pay tax at today’s low rates to avoid paying tax at tomorrow’s higher rates. If we assume that federal tax rates increase by just two percentage points across each tax bracket starting in six years time, the benefit of the Smiths’ Roth conversions jumps to $1.24m (+22%), up from $1.02m (+17%) in the case we assume no tax rate increase.

So much about retirement planning revolves around tradeoffs of risk and reward in your investments. If you want more money in retirement, you need to take more investment risk. But the beauty of the tax planning component of retirement planning is that it is usually a way to increase your expected spending power without taking on more risk. Roth conversions, as well as other tax planning techniques such as tax optimized asset location and tax loss harvesting, usually fit this bill.

NOTES & DISCLOSURES

1This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

2AlphaGlider LLC does not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstance.

Copyright © 2025 AlphaGlider LLC. All Rights Reserved.

No part of this report may be reproduced in any manner without the express written permission of AlphaGlider LLC.